Tax Credit Expertise

and Leadership

Our multidisciplinary advisors help businesses navigate

complex tax incentives and secure available savings

Our Services

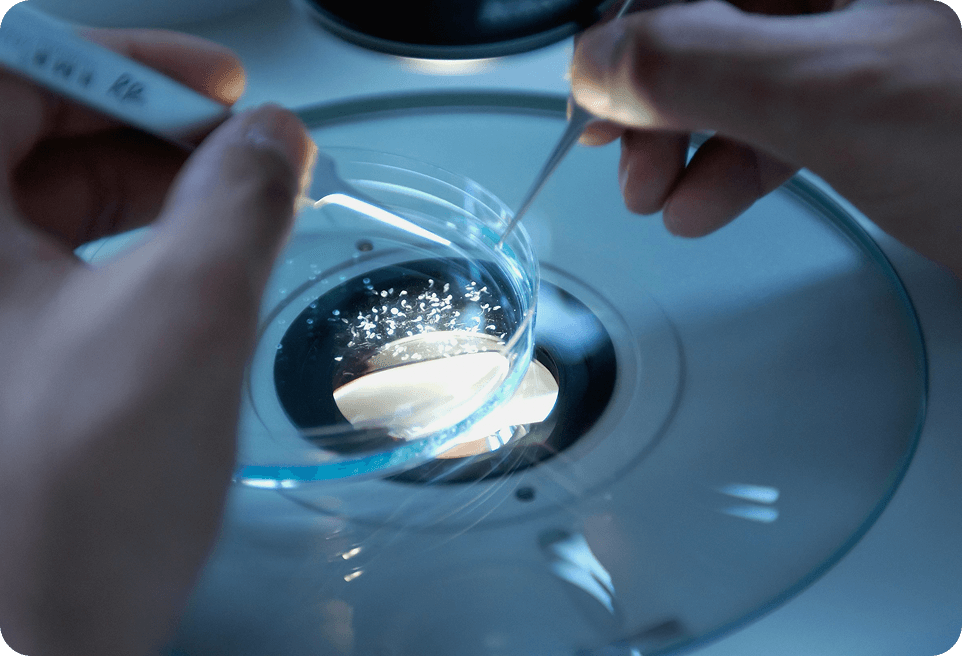

R&D Tax Credits

Income tax credits worth on average 13% of your qualified R&D expenses. Our expertise helps businesses capture the full value of this dollar-for-dollar federal and state credit.

Work Opportunity

RDIG offers a turnkey Work Opportunity Tax Credit (WOTC) service, removing the work and worry of claiming this new-hire credit, worth up to $9,600 per qualified hire.

Transfer Pricing

Avoid costly penalties and optimize your global tax position with RDIG’s compliant, strategic transfer pricing documentation service.

Empowerment Zones

Receive tax credits of up to $3,000 per qualified employee per year when companies hire & retain talent from designated economically distressed areas.

Cost Segregation

Let RDIG’s advisors enhance your tax savings further by reclassifying and accelerating depreciation on your real estate assets.

What Are R&D Credits?

The Federal Credit for Increasing Research Activities is a US tax credit designed to stimulate innovation in the US.

Companies conducting qualified research activities earn tax credits worth on average 13% of their total research expenses.

This federal credit and similar state tax credits are applicable across a broad range of industries and businesses, which companies and shareholders can carry forward into future years if unused.

Do I Qualify?

The majority of small to mid-sized companies do not take advantage of this meaningful tax credit even though they are eligible.

Turn Your R&D Wages into Tax Savings

R&D tax credits reduce income tax and, for qualifying startups, payroll tax. Use your R&D-related payroll to estimate the credit your business may be eligible for.

Actual savings vary for each company.

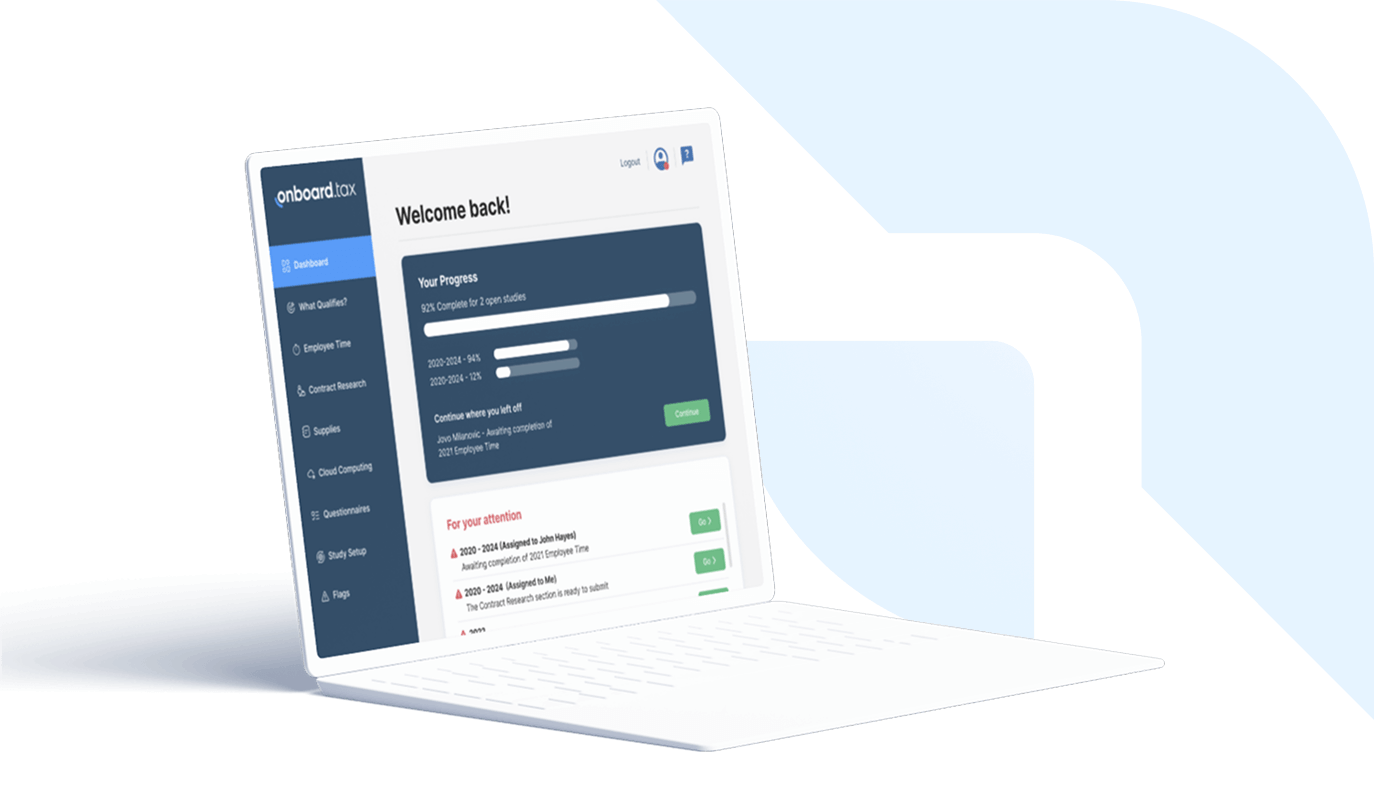

Expertise at Your Fingertips

Onboard, RDIG's proprietary R&D tax credit software, streamlines data collection while enabling close collaboration with our expert consultants, ensuring each study of our clients' qualified research expenses is thorough, accurate, and audit-ready.

We strive to build

lasting relationships.

Connect your team with ours today.

Our Leadership

RDIG was founded with the mission to provide the highest level of tax credit study service to each of our clients. A multidisciplinary team of experts is how we accomplish that mission. We are experienced tax consultants, attorneys, engineers, and technology experts leveraging decades of industry-leading experience to maximize our clients’ tax credits.

William Chang

Ruben Vardanyan

Brian Haneline

Kevin Shih

John Hayes

Helen Han