You Do the Innovation. We’ll Handle the Tax Credits.

Secure your R&D credits with expert strategy and streamlined service.

Even though eligible, the majority of small to mid-size companies do not take advantage of this meaningful tax credit.

Our expert-led studies often uncover R&D qualified expenses in places you might not expect, and the credit is worth on average 13% of all such expenses annually.

13%

of all qualified research

expenses

Our Process

RDIG produces thoroughly documented results while minimizing disruption to your business. By collaborating closely with clients and their CPAs, we’ve perfected an efficient, streamlined process for identifying and securing R&D tax credits—earning us an industry-leading client retention rate.

Free Initial Assessment

We gather key details and provide a no-obligation analysis to estimate potential credits.

Detailed Study

Using our proprietary R&D credit software and expert-led interviews, we document and substantiate your R&D activities.

Ongoing Support

We deliver comprehensive documentation and retain your records to simplify future filings.

No matter the size of your business, compiling a thorough and accurate overview of R&D expenses requires specialized expertise.

That’s where we come in. RDIG’s team specializes in conducting thorough studies to identify and document all qualifying activities and expenses, ensuring our clients can capture the full value of their credit while maintaining a comprehensive documentation consistent with regulatory requirements.

Qualifying for the R&D Credit

Any businesses investing in new or improved products or processes can qualify, as well as those engaging in technical endeavors to cut cost and remain competitive in the market place.Projects and activities which qualify for the R&D tax

credit meet all four parts of a Four-Part Test:

- Having a permitted purpose

- Being technological in nature

- Following a process of experimentation

- Eliminating some amount of uncertainty.

Permitted Purpose

To qualify for R&D credit, the purpose of the effort must be to achieve a new or improved product or process. The product or process must provide new or improved functionality, performance, reliability, scalability, and/or overall increase in quality. Efforts with this purpose will qualify, whereas simple aesthetic changes, for example, will not.

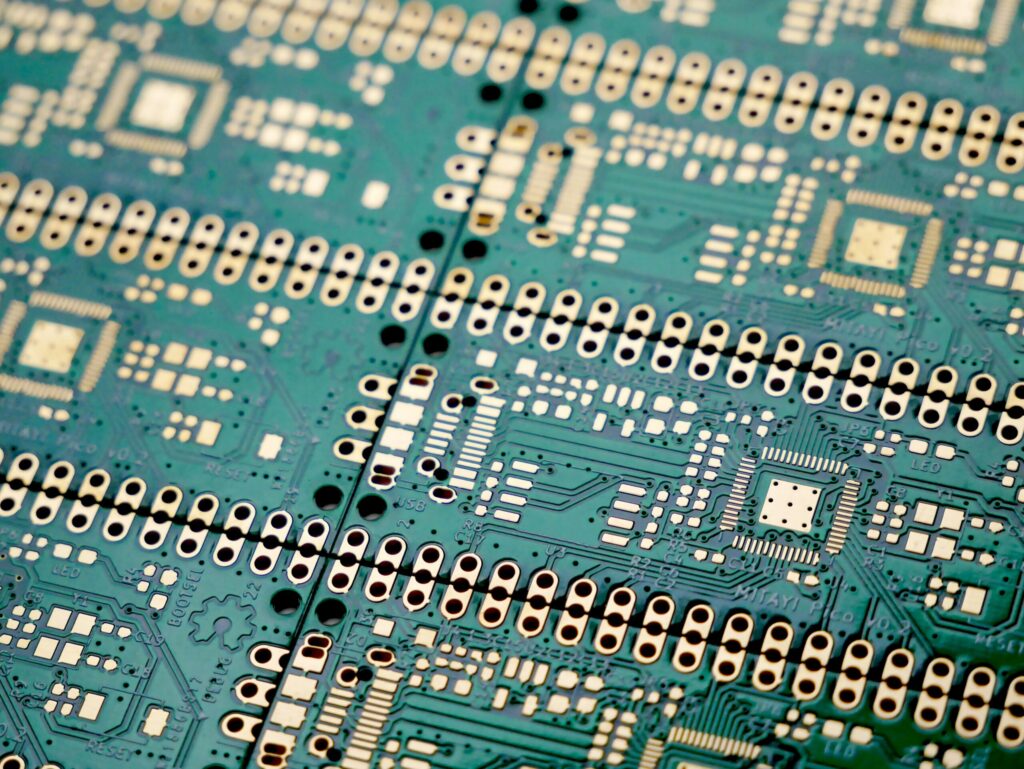

Technological In Nature

Your company’s development efforts must fundamentally rely on a hard science to qualify as research & development. Efforts that apply engineering disciplines, physics, chemistry, biological science, software engineering, material science, food science, etc. will qualify, whereas soft sciences such as marketing research, sociology, psychology will not.

Experimentation

Your research & development team must be able to demonstrate that the R&D efforts utilized a process which included the evaluation of potential alternatives to achieve the desired outcome. This could include conducting systematic trial-and-error, prototyping and first article development, modeling, or testing to validate design hypotheses and concepts in order to arrive at a final design. A process that did not involve experimentation will not qualify.

Uncertainty

There must be technical uncertainties or challenges encountered at the onset or throughout the initiative. Uncertainties concerning capability, optimal methodology, or appropriate design of the development or improvement initiatives will likely qualify. Simple fixes, routine repairs & maintenance, or routine production will not.

Do I Qualify?

Research & Development tax credits reward businesses that develop or improve products & processes, but it is a nuanced area of tax law, one in which our team has cultivated decades of expertise. Use this free assessment tool to learn quickly whether your company could qualify.

R&D Credit Assessment Tool

Find out if your business qualifies for valuable tax incentives

How Much is the Credit?

Estimate your potential R&D credit based on your industry and R&D-related payroll.

Actual savings vary for each company.

Reduce Payroll Taxes

If your business has little or no federal income tax liability, the R&D credit payroll tax offset can provide immediate savings by reducing your employer payroll taxes. Companies investing in new or improved products and processes often overlook this key cash-flow opportunity.

- Gross receipts under $5 million for the current tax year

- No gross receipts prior to the five-year period ending with the current tax year

- Up to $250,000 may be applied against Social Security payroll taxes

- An additional $250,000 may be applied against Medicare payroll taxes

Case Studies

A sample of the tax credits we are securing for our clients across a wide variety of industries.

Frequently Asked Questions

As long as there are qualifying activities and expenses here in the US, manufacturing can occur anywhere.

It’s not a refundable credit, which means that if the credit is in excess of the tax liability, you cannot get a refund greater than the amount of the tax that is owed. For example, if your tax credit is $25,000 and your tax liability is only $18,000, then you will receive a credit (refund) of only $18,000. The unused tax credits rollover and can be used in future years (up to 20 years for federal purposes).

Many of our clients were already claiming the credit. However, in many cases, they were not securing the full value of the credit. In most cases, we have been able to identify additional credits through our thorough interview process and industry expertise. With a no-fee assessment, there is no reason not to get a second opinion.

Unlike a tax deduction, an R&D tax credit is a dollar-for-dollar credit; this reduces a taxpayer’s bill by a full dollar for each credit dollar. A six-figure tax credit increases Earnings After Tax by the full amount of the credit. A tax credit that can be used to reduce the taxes to be paid means that much more cash in the company’s bank account.

You may still benefit from the R&D credit even without taxable income. Qualified small businesses (those with less than $5 million in gross receipts for the current year and no gross receipts more than five years ago) can elect to use the credit to offset up to $500,000 of the employer’s share of Social Security and Medicare payroll taxes each year. This makes the credit valuable for pre-revenue or loss-making startups, since it can directly reduce employment tax liabilities and improve cash flow.

Because the credits can be claimed in one year and taken in another year, they can be transferred to new ownership. The credits also legitimize a company’s technology. A lot of small companies claim the credit every year because they are looking to be acquired by a larger corporation, and if they have R&D credits on their books it proves they have technology someone else is likely to value.